While general Zimbabweans celebrated the landmark victory that saw mobile tariff being reduced from the all-time highest of 23cents to 15cents, the truth on the ground is that the effects of the same move are more detrimental.

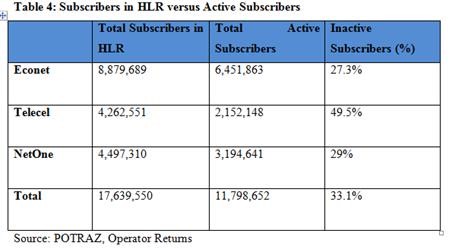

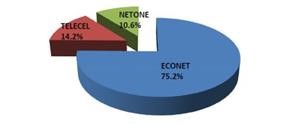

According to an official government report, revenue generated by the three mobile operators thus Econet, NetOne and Telecel in the second quarter of 2015 was $183,164,014. This represents a 2.9% decline from $188,546,864 recorded in the previous quarter.

Mobile network operators registered a 14.2% decline in quarterly revenues in the first quarter and the total value of mobile money transfers in the quarter declined by 7.7% to record $406,988,613 from $445,722,792 while it continued to soar with a decline in traffic in the second quarter leading to the 2.9% drop while the fixed network saw a drop to 14.6% decline.

Revenue from fixed telephone voice service declined by 14.6% to record $30,533,976 in the second quarter of 2015 from $35,633,976 recorded in the previous quarter. This is a $190 million decline in potential revenue earned by the sector combined.

Zimbabwe, regionally was the most expensive, making access to communication a privilege not a right, hence the government through the national regulator Potraz was equally right in seeing the adjustments of these tariff to make access to information and communication a right to all.

While this was obviously a good move on the government, they probably approached the matter without carefully seeing how the same move would not only affect the operators, but themselves as well as they heavily rely on taxes and commissions made from the same telecommunications business.

This year Econet Wireless Zimbabwe and Telecel Zimbabwe have sent many of their employees packing due to harsh operational environment and low returns, which are a direct effects of tariff cuts and low revenue streams. The mobile sector combined in Zimbabwe is the second largest tax payer, which means it has been greatly contributing to the fiscus to give government the same funds it needs to run critical operations like salaries towards its wage bill.

The national Postal and Telecommunications Regulatory Authority of Zimbabwe, POTRAZ which is the arm that is used by government to issue the 35% tariff cut also heavily depends on the mobile, fixed and Internet Access Providers (IAPs) operators for its functionality.

Mobile operators are required to pay a whopping $137.5 million licence fee to Potraz, probably one of the highest in the region. There are also a plethora of other taxes and charges including the Universal Service Funds, levy and other monthly commissions charged per profit margins.

Overall, the Zimbabwe government separately introduced 70% dip in returns caused by 5 percent excise duty on airtime sales, a 25 percent duty on handsets and ICT products and a 5 cents levy per transaction on mobile money transfers, compounded by the 35 percent voice tariff reduction which only Econet fought against Potraz through the courts.

For Econet Wireless Zimbabwe, it seemed it lost the court case which even appealing through the Supreme Court still lost the case with costs, while on ground the battle was lost for all the operators which are now finding it very difficult to operate in such an environment.

The effects should have been predictable as Econet led the toll orders resigning hundreds, and for once the company that was a dreamland for many was seen struggling and left with no option but offload any excess baggage.

Thousands today have been sacked off as reality is now sinking and detecting to the balance sheets. The profit margins have greatly shrinked this year for all telecommunications operators forcing them not to only adjust their spending habits but also affecting critical operations like marketing, research and development.

According to Potraz 4th quarter report of 2014, the highest Average Revenue per User per month (ARPU) per month was registered by Econet at $8.17 while Telecel`s (ARPU) remained flat at US $4 in those 9 months and Net One had the lowest ARPU at $3.35. For the fixed operator, the total number of minutes processed recorded on fixed telephone network declined by 3% to 189 059 292 from the previous quarter according to Potraz report.

Mobile money transfer subscriptions went up by 7.3% from 4.9 million subscriptions and stood at 5.3 million at the end of 2014 The total value of transactions for mobile money services have increased in value to $445.7million from $403 million recorded in the third quarter which translates to a 10.6% increase. The continued decline in total mobile revenues can be attributed to alternative modes of communication which are Over the Top (OTT) services such as Whatsapp, Viber and Skype.

Maybe government can save the crisis by relooking into the tariff or the players will need to be more innovative and create products that will woe more traffic and subscribers to their network should they survive till 2017.

- Technomag/Herald